The Case for International Diversification

The United States’ equity market has been on a tear. US stocks have outperformed international stocks over the past one year, three years, five years, 10 years, and 20 years.

Figure 1: Performance of US Market vs. International Markets through Q3 2018

Source: CapitalIQ

The outperformance of the US markets has persisted long enough that some might be tempted to assume it as a general rule: that the market has recently revealed a longer-term truth. It’s seductively easy to come up with arguments as to why this trend should persist.

But we do not believe that trend extrapolation is an effective way to predict the future. Rather, we prefer base rate forecasts. And we do not think that the strength of the US markets in the last five years is a good reason to eschew international diversification, particularly when foreign markets account for over 50% of global equity market capitalization.

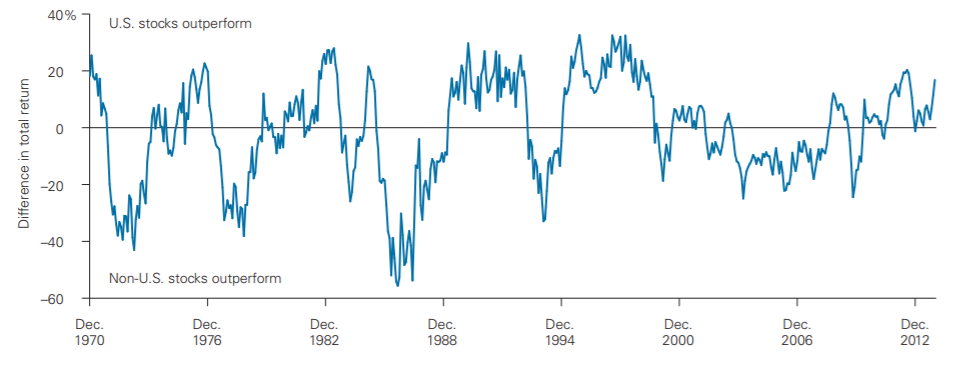

The base rate statistics supporting international diversification are strong. Over longer periods, the United States’ outperformance of international markets has been a coin flip.

Figure 2: Trailing 12-Month Return Differential between US and Non-US Stocks

Source: Vanguard

Adding foreign stocks to the portfolio has historically reduced volatility in addition to improving returns.

Figure 3: Proportion of maximum volatility reduction achieved by including non-U.S. Stocks

Source: Vanguard

A large percentage of US outperformance has come recently from a strong dollar, and investors might be tempted to say, “Fine, put some money in foreign stocks, but at least hedge the currency.” But base rates would suggest that over the longer period, there’s no strong reason to hedge currencies.

Historically, currency movements have been uncorrelated to stock market performance, enhancing the diversification benefits of investing abroad. And for every year the USD has outperformed international currencies, there’s been another the USD has underperformed.

Figure 4: Annualized Contribution of US Dollar to Non-US Equity Returns

Source: Vanguard

The message from history is clear: international diversification, with no currency hedging, will be a long-term benefit to your portfolio, both in reducing volatility and in enhancing returns. Trend extrapolation and returns chasing are not reason enough to cast aside the base rates of history.

After a long stretch of USD strength and US stock market outperformance, we believe it’s time for investors to look abroad for opportunities. The continued outperformance of US equities has left the US market trading at significantly higher valuations than international markets.

Figure 5: US Valuations vs. Japan and Europe

Source: Star Capital

Averaging across these three valuation metrics, Japan trades at 47% of US valuations while Europe trades at 60%. We believe that entry valuations—not recent performance—are the best predictor of returns. For these reasons, we think the case for international diversification has rarely been stronger than it is today.